I have two surveys for you that I think you’ll love.

The first is one that I’m asking you to take: a cut-through-the-BS survey on the real ways in which you’re seeing gen AI used in your organization — or not. This data will contribute to the “Martech for 2025” report and virtual event Frans Riemersma and I will be sharing on December 3. More details to follow. Both of us and thousands of your peers who will read this will be immensely grateful for your contribution. Take the survey here. Thank you!

(As a little bonus for taking the survey, you’ll receive a special edition of our marketing technology landscape graphic that focuses exclusively on the thousands of AI martech startups we’ve cataloged over the past year.)

The second survey — the 2024 Martech Replacement Survey run by my good friends at MarTech.org — is one you can download the full report, free and ungated, now. They’ve been running this survey for 5 years, and it’s one of my favorite for insights into how and why martech stacks are evolving.

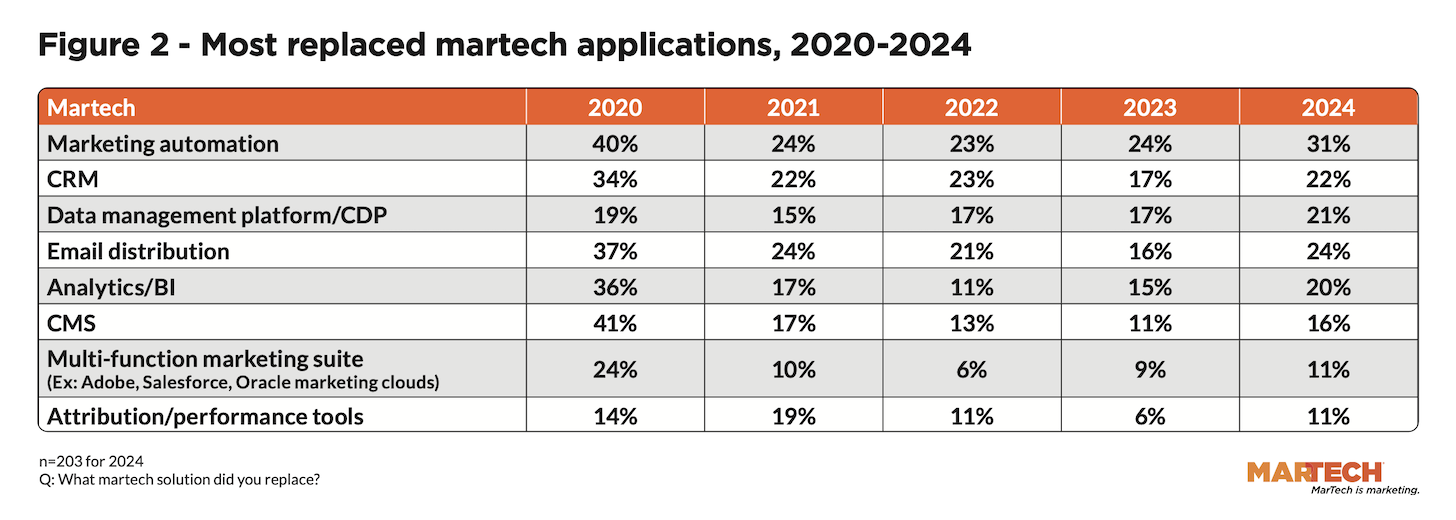

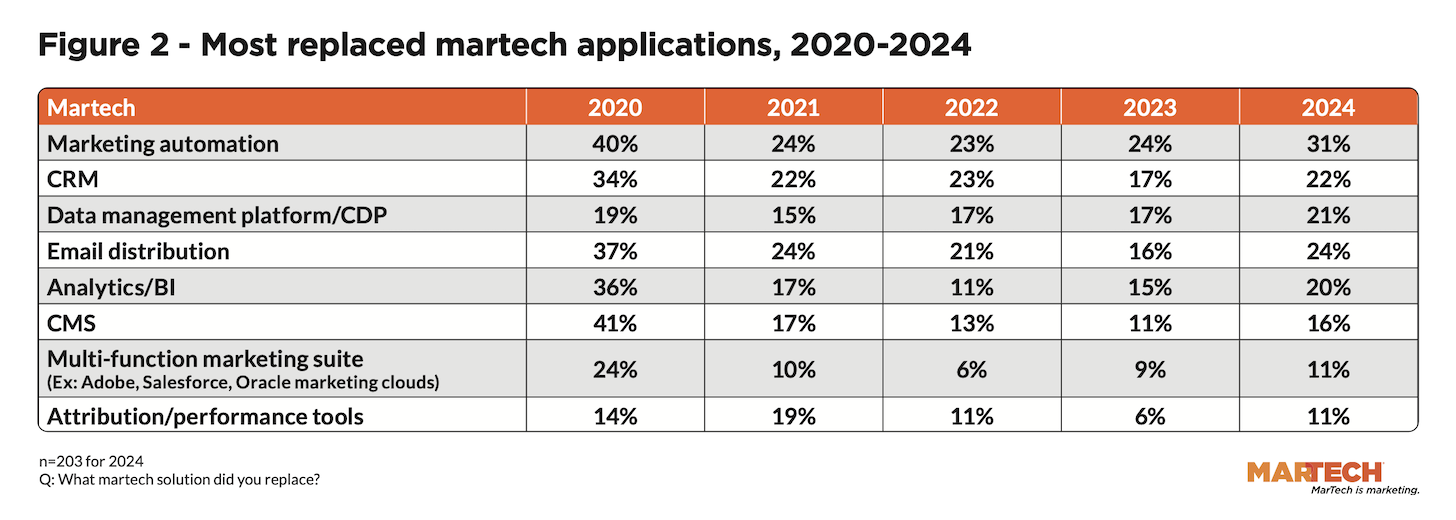

Out of 496 respondents, a full 65% reported that they replaced one or more martech solutions in their stack over the past year. These are the applications most frequently replaced:

What immediately leaps out is the significant uptick in replacements across the board compared to the past two years. 31% replaced their core marketing automation platform. 22% replaced their CRM. 21% replaced their CDP. That’s a lot of upheaval!

(Note: 58% of the respondents were in B2B, 42% in B2C.)

There are three different theories as to what is driving this.

- Theory #1: the industry is consolidating and people are switching off of the also-ran products in a category to go with one of the top 3-5 leaders.

- Theory #2: people are switching from one leader in a category to another, better optimizing for factors that we’ll discuss in a moment.

- Theory #3: people are switching to brand new challenger products in the category.

My guess — and this is purely a guess — is that all three theories are at play in today’s market, but mostly in the order in which I’ve listed them. I believe the majority of shifts in these primary martech categories are coalescing forces around their respective leaders. (Disclosure: I am also the VP of platform ecosystem at HubSpot, which is seen as one of those leaders, so assume I’m biased.)

“So martech is finally consolidating!” you might be rejoicing.

To which I would reply, “Yes, but…”

Yes, but the history of martech over the past 16 years has been one of simultaneous consolidation on one end and new expansion through disruptive innovation on the other end. And one of the data points from this Martech Replacement Survey suggests that paradox is still alive and well:

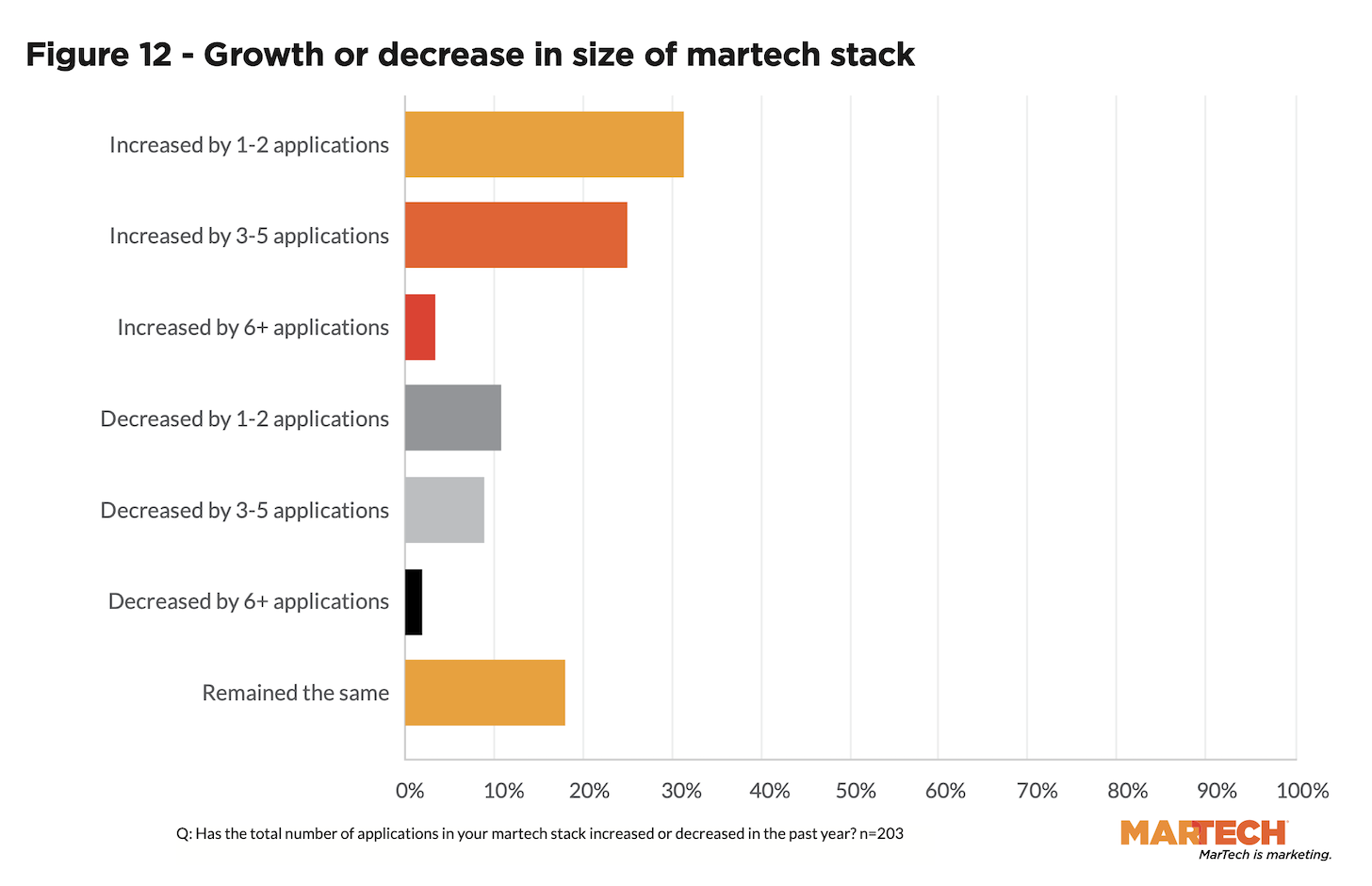

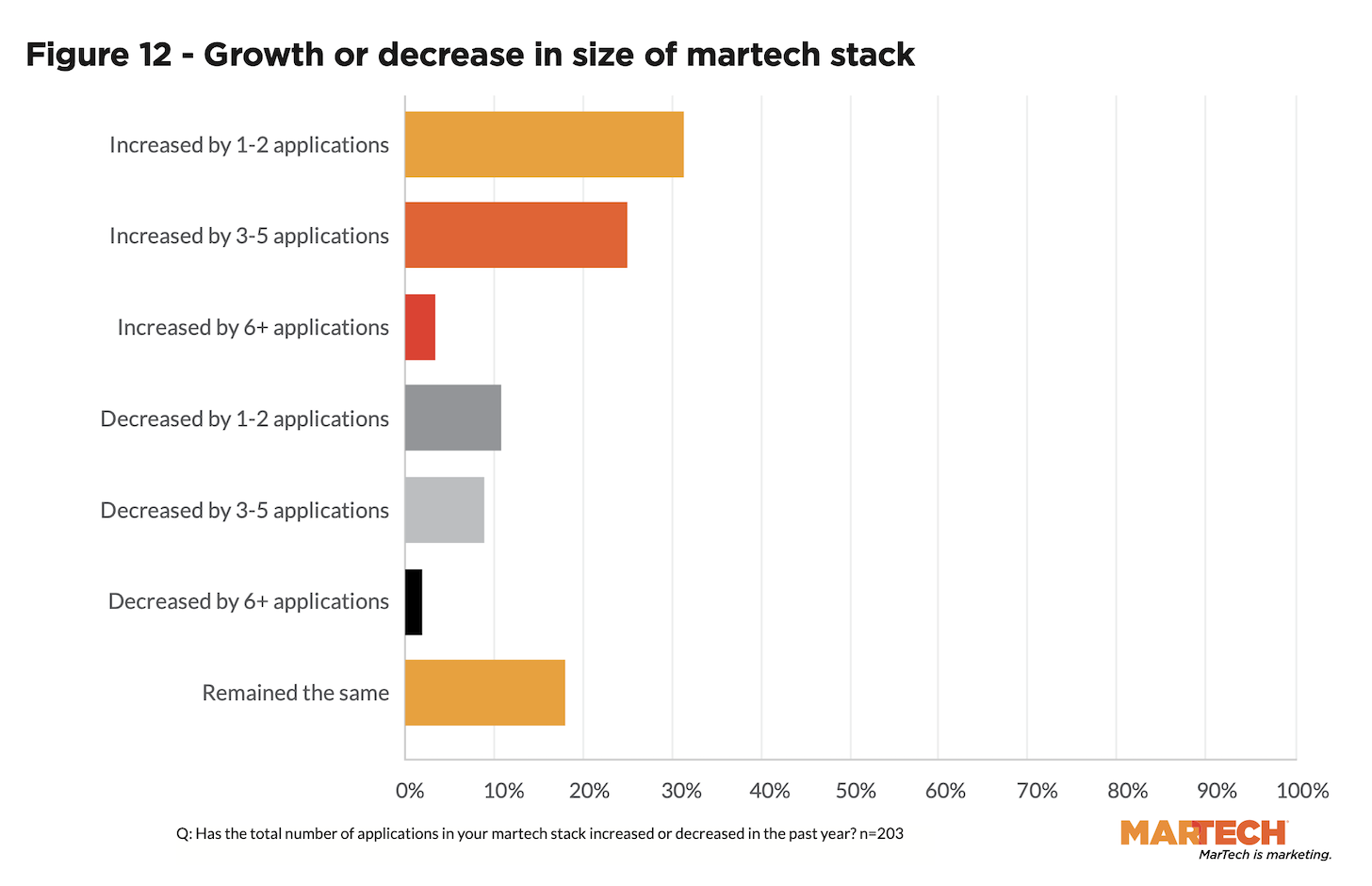

The majority — 60% — of the respondents who said they replaced a matech application in the past year, also said their total martech stack grew by 1-2 apps, 3-5 apps, or 6+ apps. Another 18% said their stack remained the same size.

Only 22% said their martech stack shrank.

If I were to take yet another guess, I suspect this is both consolidation and expansion happening simultaneously. Their replacement of one martech app with another may have eliminated other apps from their stack. But at the same time, new disruptive innovations and evolving marketing requirements led them to add net new apps to the mix.

This leads to the finding that is most interesting to me, highlighted at the top of this post:

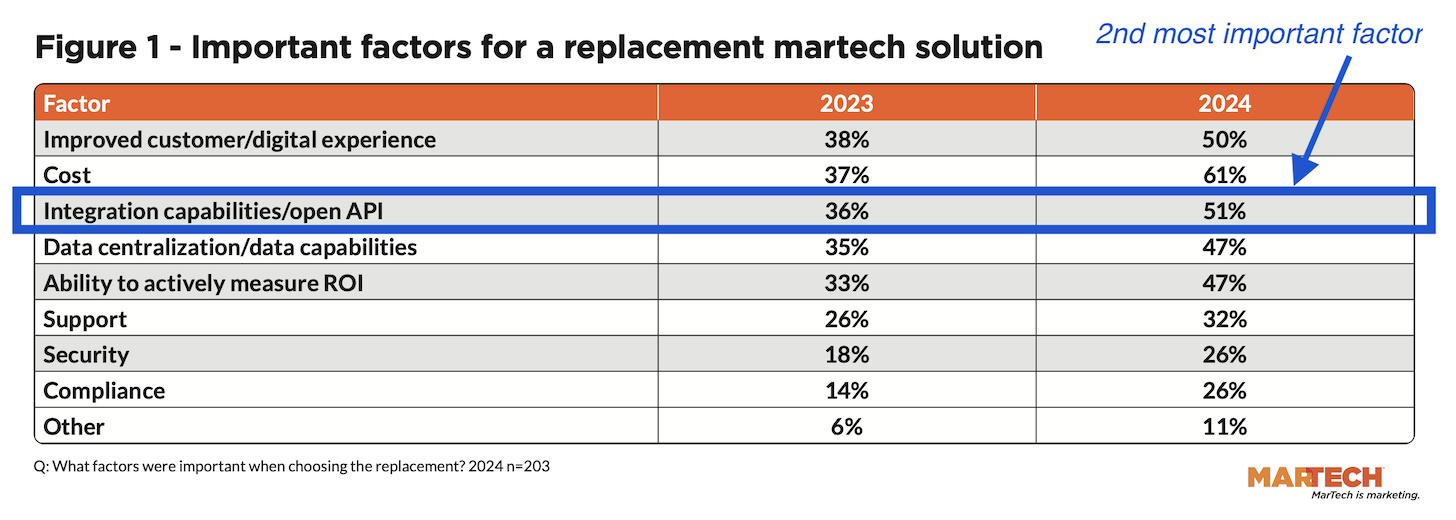

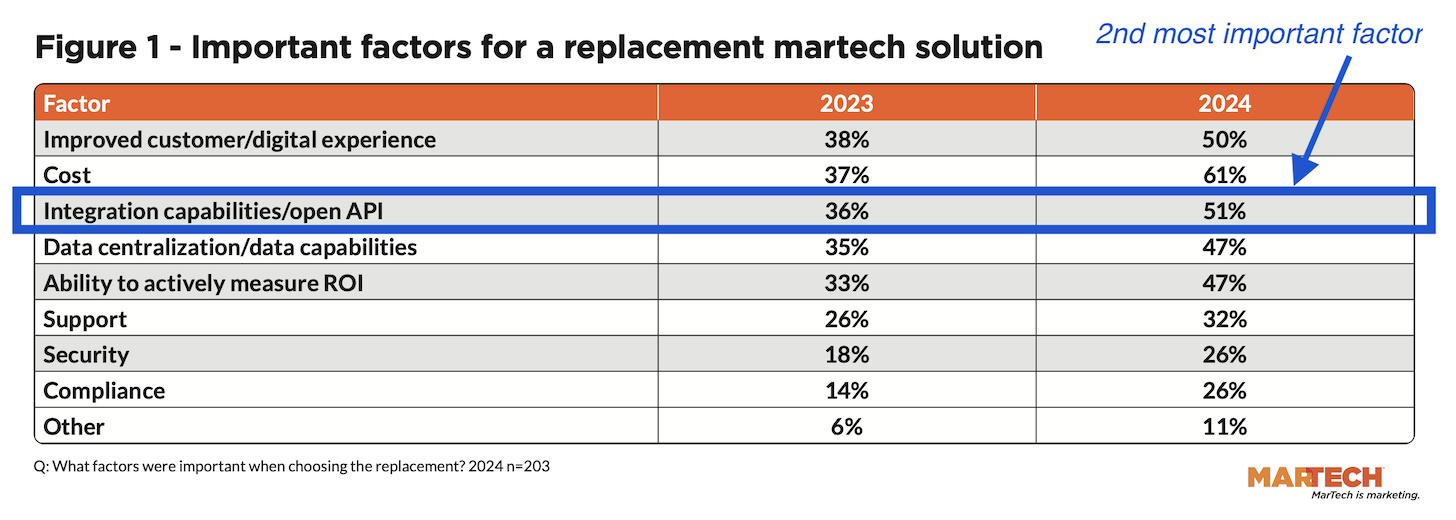

When people replace one martech solution with another, what factors are most important to them in the new solution they choose?

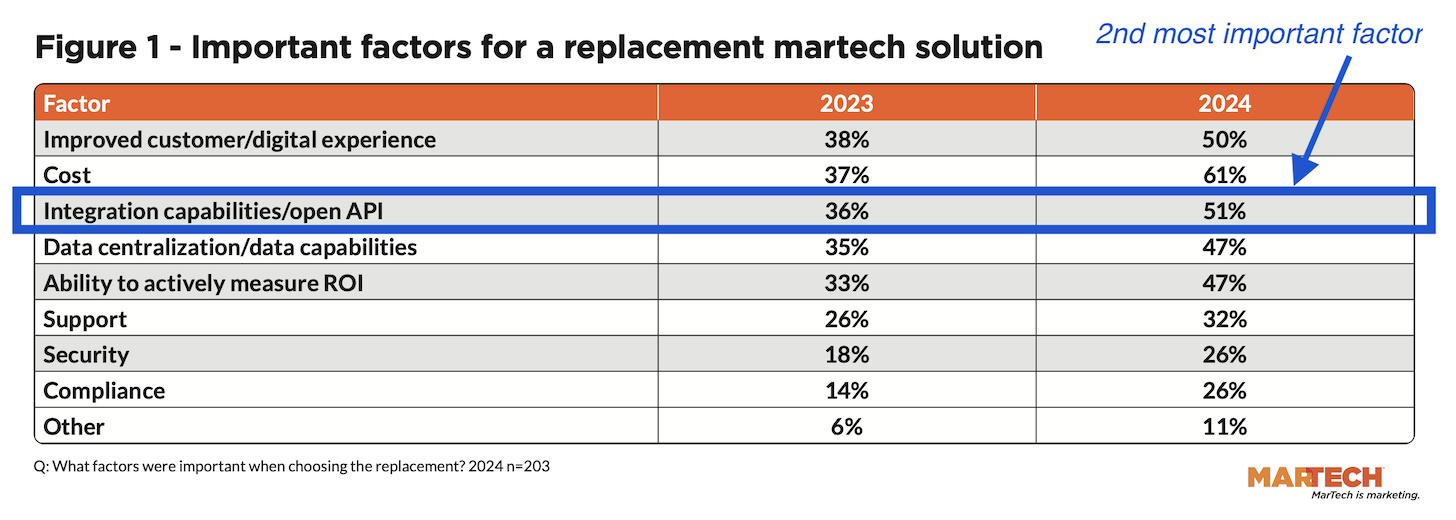

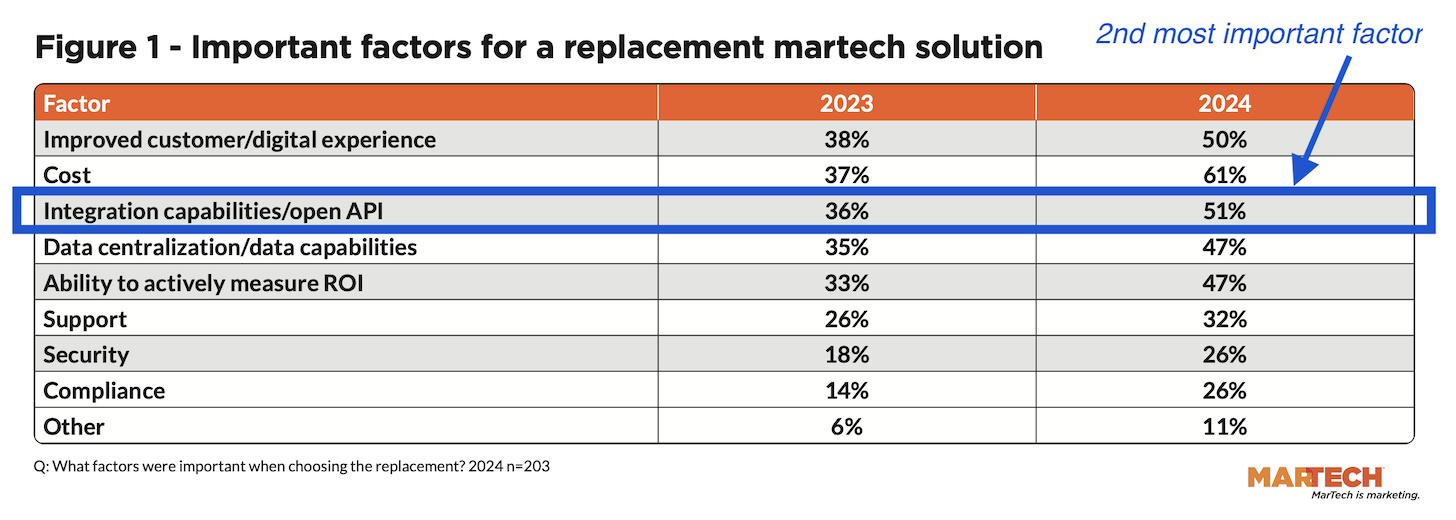

You can see the handprint of the CFO and fiscally-minded marketing ops leaders on “cost” being the #1 factor this year, with 61% citing it as an important factor. Good.

However, the #2 most important factor is “integration capabilities/open API” with 51% citing it. This shouldn’t come as a surprise — integration has remained at the top of marketers’ demands for better martech for years. Our own State of Martech 2024 report back in May showed that APIs are very important to martech buyers, not only for today’s use cases, but in support of the new data layer emerging in many companies and preparation for the next wave of AI-powered automation.

Improved customer/digital experience is #2. Data centralization/data capabilities and ability to actively measure ROI are tied for #4. (As I’ve noted before, APIs, data centralization, and measuring ROI are kind of all bundled together to unify marketing oeprations.)

I know, I know, security and compliance should be much higher than 26%. My third and final guess is that these are actually seen as “givens” — the purchase simply won’t pass the approval process if these requirements aren’t satisified — and so it’s not criteria that marketers spend a lot of time consciously debating in the selection process.

Overarching takeaway: martech is definitely not standing still.

P.S. Please take on our gen AI survey for Martech for 2025 and get that bonus AI martech landscape. Thank you!